Why Government Support for Decarbonizing Oil and Gas Is a Bad Investment

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy brief is part four of The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary:

-

Oil and gas use is driving climate change, and prolonged extraction and increased production are not compatible with the global climate goal to limit warming to 1.5°C.

-

The Canadian oil and gas industry has sufficient funds to invest in decarbonizing its production, particularly in light of recent windfall profits.

-

However, despite some companies’ 2050 net-zero targets for their operations and a recent commitment to invest in decarbonization technologies, the industry has failed to take the necessary steps to reduce its emissions this decade. A credible 1.5°C trajectory requires substantially reducing emissions in the near term, as well as meeting longer-term targets.

-

The industry already receives significant government financial support, and the federal government has committed to ending this support by phasing out inefficient subsidies and public finance for the sector in the near term.

-

Existing government support for decarbonizing the sector has not been consistently successful in lowering emissions.

-

Further support to the sector comes with significant opportunity costs, will slow the energy transition, and entails economic risk, including public liabilities. Public dollars are more effectively spent supporting readily available and proven low-carbon technologies.

As the world moves to limit the worst impacts of climate change, addressing the immense challenge of decarbonizing high-emitting industries is increasingly urgent. Canada’s largest source of greenhouse gas emissions, the oil and gas sector, is under pressure to curb its emissions. While long-term reliance on oil and gas production is not compatible with global climate goals, lowering emissions from current Canadian oil and gas production is also critical in the short term to ensure early emissions reductions before 2030, particularly given the outsized contribution of the sector’s emissions and the stepwise nature of the transition. Reducing these emissions through readily available actions like electrification, process improvements, energy efficiency, and addressing methane leakage is essential to meeting Canada’s 2030 target of 40%–45% reductions below 2005 levels. Despite uncertainty regarding its deployment, carbon capture, utilization, and storage (CCUS) has also garnered significant attention as a proposed technology to reduce the sector’s emissions, but it is not expected to contribute significantly to reductions before 2030. Although operations- and production-related emissions represent only a small fraction of overall life-cycle emissions from oil and gas, they have been the primary focus of government and corporate net-zero targets and commitments for the sector.

To date, the Canadian federal government has directed a substantial amount of public money toward decarbonizing the oil and gas sector. One of the largest supports is the new investment tax credit for CCUS projects, estimated to cost up to CAD 1.5 billion per year to 2030. Aside from the tax credit, the federal government has provided CAD 2 billion in support to CCUS since 2000. Other federal programs have aimed to support decarbonization projects in the sector as well, such as the CAD 750 million Emission Reduction Fund and Export Development Canada’s new “transition bonds”. The new CAD 8 billion Net Zero Accelerator initiative supports large investments in the decarbonization of key industrial sectors and is expected to include allocations for oil and gas. Provincial governments also direct substantial funds toward decarbonizing the sector. For instance, Alberta has allocated significant subsidies for CCUS projects through the CAD 750 million Technology Innovation and Emissions Reduction Fund.

With limited public dollars available to fund the energy transition, it is critical to assess whether such supports are an appropriate use of public funds or whether they present an opportunity cost—reducing the money available for clean, viable, long-term energy solutions.

Oil and Gas Are Driving Climate Change, and Further Investment Slows the Clean Energy Transition

The Intergovernmental Panel on Climate Change’s (IPCC’s) Sixth Assessment Report declared the evidence that humans are driving climate change “unequivocal,” with the production and use of oil and gas being major drivers. Carbon dioxide created primarily through the burning of fossil fuels accounted for 80% of total emissions in Canada in 2020, with an additional 7.4% from fugitive methane emissions alone. Globally, net emissions have continued to increase across all sectors, including oil and gas, since 2010. The IEA’s net-zero scenario finds that no new fossil fuel fields need to be developed in a world where global warming is limited to 1.5°C. In the same scenario, oil and gas production decline by 75% and 55%, respectively, by mid-century. As a result of changing markets, global net-zero pledges, and ratcheting climate commitments, leading energy scenarios, including the IEA’s, forecast a steep decline in oil demand beginning by 2030.

Nonetheless, a major focus of Canadian net-zero policy discussions has been the decarbonization of the oil and gas sector, given that the sector is responsible for approximately 27% of Canada’s emissions. Decarbonizing production is essential in the short term, particularly to ensure meeting Canada’s 2030 target, but ultimately does not reduce the vast majority—70% to 80%—of the life-cycle emissions created when those fuels are burned. Canada exports more fossil fuels than it uses domestically, meaning that emissions from the end uses of Canadian oil and gas exports are higher than total domestic emissions from all sectors—30% higher in 2019, at a total of 954 Mt. Because of the export orientation of the Canadian oil and gas sector, declining global demand poses a significant risk to the sector that cannot be fully addressed by decarbonizing production.

Government financial support for decarbonizing oil and gas decreases the cost of production, prolongs the lifespan of projects, and can enable increased production, making the transition to renewable energy more difficult. Prolonging production in a sector that will decline in a world that successfully limits warming to 1.5°C globally is inconsistent with Canada’s climate goals. This support also increases the risk of stranded assets in the context of a shifting energy landscape. A recent study estimates that the value of stranded assets in the oil and gas sector exceeds USD 1 trillion globally, including around USD 100 billion in stranded assets in Canadian oil and gas fields. Government-supported projects that risk becoming stranded assets, including decarbonization projects whose viability relies on continued demand, would result in financial risk, and any ensuing costs would be borne by Canadian taxpayers.

Oil and Gas Companies Do Not Need Government Support to Decarbonize

The “polluter-pays” principle holds that the private sector should be financially responsible for managing the environmental damage it causes. In the case of oil and gas, this includes both lowering production emissions and taking responsibility for downstream climate impacts that result from the fuels being burned.

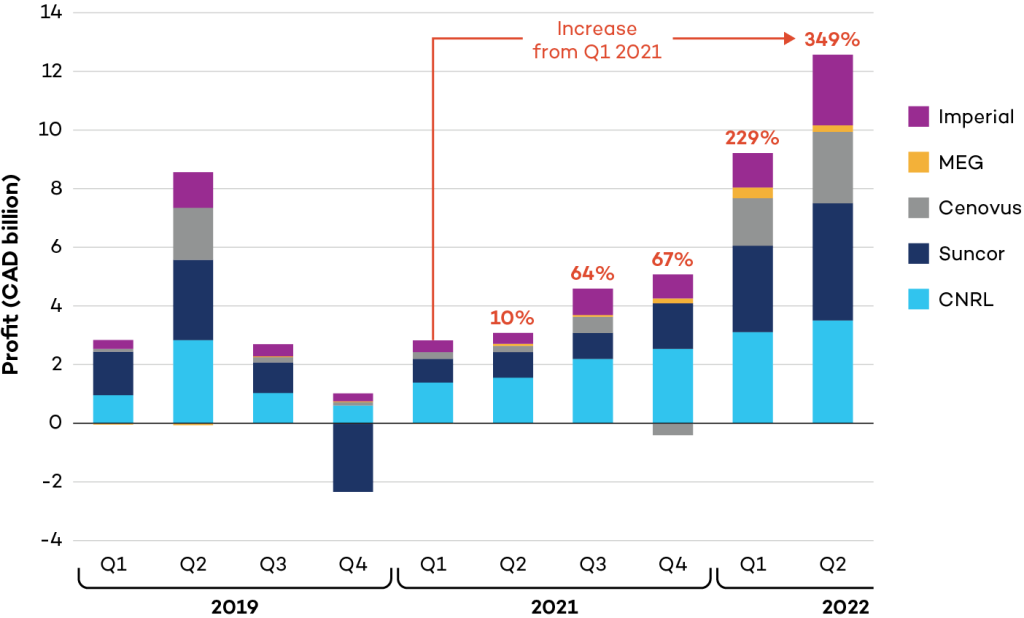

Oil and gas companies are well positioned to cover these costs, particularly in light of recent windfall profits due to high energy prices exacerbated by Russia’s invasion of Ukraine. Canadian oil and gas companies’ profits are projected to reach CAD 152 billion this year, while five of the biggest firms have seen a nearly 350% increase in free cash flow from the first quarter of 2021 to the second quarter of 2022. For example, on the same day that the CEO of Cenovus requested more government investment in CCUS, the company announced a sevenfold increase in quarterly profits.

Figure 1. Profits of five oil and gas companies pre- and post-pandemic

Given these profits, oil and gas companies should be able to prioritize lowering emissions without government support. Government spending on oil and gas decarbonization would contribute to lowering the cost of production without guaranteed reductions in emissions. For example, in 2021 Canadian Natural Resources Limited invested CAD 84 million in emissions reduction research and development. This investment was found to have little impact on absolute net emissions reductions—while the company expects to return CAD 14 billion to shareholders between 2021 and 2022.

All economic sectors, including the oil and gas industry, have a responsibility to reduce emissions in line with global climate goals. The electricity sector has reduced emissions by 52% since 2005, while emissions from heavy industry have dropped by 18%. Meanwhile, emissions from the oil and gas sector increased by 20% from 2005 to 2019. Emissions reductions will only be effective if we see economy-wide action; failure to decarbonize in one sector puts additional and unfair pressure on other sectors to make up the difference.

The Industry Has Yet to Demonstrate Sufficient Commitment to Climate Action

In recent years, the oil and gas industry has voiced recognition of the need to address climate change and publicly positioned itself as part of the solution. In 2021, Canada’s largest oilsands producers established the Pathways Alliance, which set a target of net-zero emissions from oil sands production by 2050.

Current research (Corkal, 2022; Rogelj et al., 2021; Science Based Target Initiative, 2020) shows that, to be effective, oil and gas sector net-zero targets should, at minimum:

-

Be aligned with or exceed Canada’s climate commitments.

-

Emphasize early, deep, and absolute emissions reductions.

-

Include interim targets for 2030 that are in line with IPCC 1.5°C pathways and do not rely heavily on carbon dioxide removal or CCUS.

-

Outline clear plans to end exploration for and development of new oil and gas fields.

-

Cover Scope 1, 2, and 3 emissions.

The net-zero plans of oilsands majors are, however, inconsistent with these criteria: many companies omit Scope 3 emissions, do not include robust interim targets, and/or rely heavily on carbon offsets rather than absolute emissions reductions.

Meanwhile, Canadian oil and gas companies plan to expand production of oil and gas by nearly 30% from 2020 to 2030, which would lead to a 25% increase in associated annual emissions. Existing Canada Energy Regulator scenarios—which are not aligned with the 1.5°C target—also forecast increases in oil and gas production. Reducing the emissions intensity of production is insufficient in a context of growing production since overall emissions will still increase.

Despite some industry net-zero announcements, existing government supports, continued calls to action, and windfall profits, Canadian oil and gas companies have not made substantive financial commitments to decarbonization, nor have they released sufficiently detailed plans for their emissions reductions. Instead, they are directing record portions of their cash flow toward shareholder benefits. Despite methane reductions being one of the most cost-effective and impactful means of climate mitigation, action by Canadian companies to reduce methane has been slow, and methane emissions from the sector remain largely underestimated.

The Pathways Alliance committed to investing CAD 24 billion in emissions reduction projects between now and 2030. This figure may sound significant; however, spread over 8 years it represents only 2% of these companies’ annual profits based on projected 2022 revenues. Further, they plan to invest the majority of this amount in carbon capture and storage, which is not expected to lower emissions by 2030. Notably, the group has indicated that the commitment is conditional on further government support for their proposed projects.

At the same time, the industry has pushed back significantly on emissions regulations while lobbying extensively for government financial supports. The Canadian Association of Petroleum Producers opposes the federal government’s forthcoming legislation to cap and cut emissions from the oil and gas sector. The group also lobbied for the CCUS investment tax credit to cover 75% of the costs of building CCUS facilities, which is the level they deemed high enough to make companies’ own investment in the technology worth their while. When the government announced a 50% CCUS investment tax credit, many oil and gas companies claimed it would be insufficient to incentivize them to reduce their emissions. This raises questions about whether the sector is financially viable in the long term if the industry itself is not able to invest without substantial public support.

Additional liabilities to taxpayers

The industry already has a track record of unpaid taxes and environmental liabilities for which Canadian taxpayers may be held liable. For instance, oil and gas companies owe Alberta municipalities CAD 253 million in unpaid property taxes. Additionally, there are 300,000 oil and gas wells unreclaimed in the province, which the Alberta Liabilities Disclosure Project estimates would cost between CAD 40 to 70 billion to clean up. On a national scale, cleaning up abandoned wells—those that do not have a known, financially viable operator—would cost an estimated CAD 361 million as of 2020, which is expected to rise to CAD 1.1 billion by 2025.

Reducing the emissions intensity of production is insufficient in a context of growing production since overall emissions will still increase.

Government Support for Decarbonizing Oil and Gas Has Not Yielded Meaningful Results

Governments across Canada already provide substantial subsidies and other supports, such as public finance to the industry. Subsidies of at least CAD 4.8 billion per year are provided through measures such as tax breaks and direct cash transfers by both provinces and the federal government. For example, since 2019 the Alberta government has provided CAD 4.3 billion in tax cuts to the four largest oil sands companies. Meanwhile, in the same period these companies cut thousands of jobs and increased profits for executives and shareholders. In addition to fossil fuel subsidies, Canada is among the largest providers of public finance to oil and gas in the world, averaging CAD 11 billion per year between 2018 and 2020.

The federal government has made multiple commitments to phase out financial support for the fossil fuel industry: to end inefficient fossil fuel subsidies by 2023; to end international public finance for unabated fossil fuels by the end of 2022; and to eventually end all public financing (including domestic) for fossil fuels (though no date has been specified). Action on these commitments is lagging; Canada is last among 11 OECD countries ranked on progress to end support for fossil fuels and is not on track to meet its Glasgow commitment on international public finance. Further support, even for decarbonization, could undermine domestic and international commitments on climate change and ending support for fossil fuels.

Previous government support aimed at decarbonizing oil and gas production has not been consistently successful and in some cases has actually led to increased overall emissions. The Onshore Program of the Emissions Reduction Fund—a fund providing up to CAD 675 million to oil and gas companies for emissions reductions—failed to achieve emissions reductions value for money. The Office of the Auditor General found that 27 of the funded projects led to an increase in oil or gas production, which lessened or outweighed the emissions reduced, due to a lack of sufficient safeguards. In another example, CAD 1 billion in federal funds for the cleanup of abandoned and inactive oil and gas wells distributed through Alberta’s Site Rehabilitation Program likely replaced industry’s own cleanup budget, lowering the cost of business for producers, and failed to create the number of expected jobs.

Public Money Can Best Support Emissions Reductions Through Other Sectors

Government funds for decarbonizing the economy are limited, and funding must be prioritized to ensure the effective use of public money. Support for decarbonizing the oil and gas sector comes with significant opportunity costs for advancing other viable low-carbon solutions and for supporting workers and communities through economic diversification.

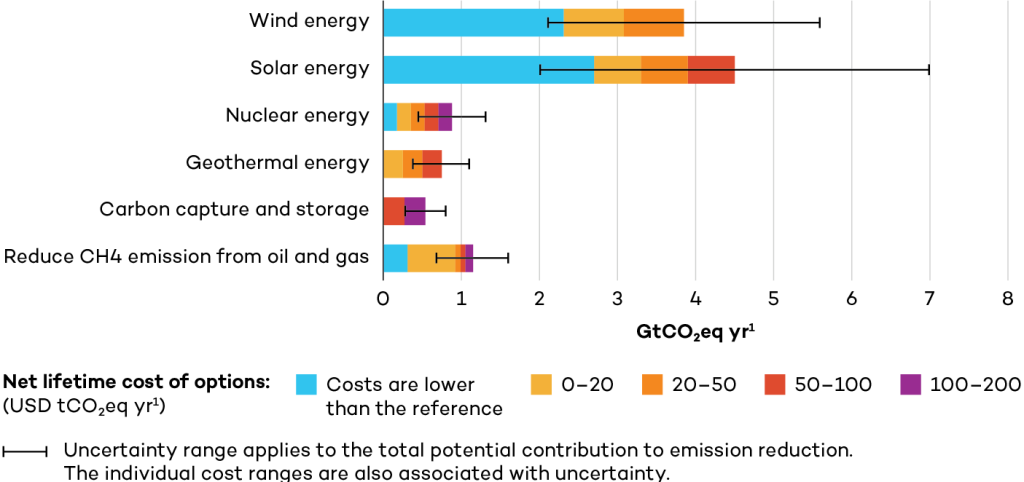

CCUS, a technology increasingly favoured by the Canadian oil and gas sector, is among the most expensive decarbonization measures with the lowest potential for emissions reductions globally by 2030. CCUS requires significant infrastructure buildout, including pipelines, making it slow to come online, and it has not been proven cost effective at scale. As a result, it is considered a “wild card” technology that is not expected to significantly impact emissions before 2030. Analysis has found that the seven operational CCUS plants in Canada capture only 0.05% of national emissions. Further, 70% of carbon captured in Canada is used for enhanced oil recovery—that is, to increase production. The IPCC warns that overreliance on carbon dioxide removal and CCUS poses a major risk to achieving the goals of the Paris Agreement and outlines 26 energy pathways to 1.5°C that make little use of these technologies.

Figure 2. The emissions reduction potential and cost of various mitigation options in the energy sectors globally according to the IPCC

Prioritizing government spending on proven and cost-effective clean technologies such as renewable energy, building retrofits, and clean and scaled-up electricity grids is the most reliable way to support a swift transition to a low-carbon society. The cost of renewable energy has plummeted in the past decade, making many clean technologies competitive with conventional energy sources. From 2010 to 2019, the unit cost of solar fell by 85%, wind by 55%, and lithiumion batteries by 85%, resulting in large increases in their deployment globally. Wind and solar energy have some of the greatest potential to contribute to emissions reductions globally in 2030 at relatively low costs.

Investing in renewable energy and electrification can increase both affordability and energy security for Canadians (Christensen & Dusyk, 2022; Thomas & Green, 2022). This would protect Canadian consumers from the volatility of global fossil fuel markets and geopolitics while furthering the federal government’s commitments to having a non-emitting electricity grid and no new combustion engine vehicles by 2035. While investment from the private sector will undoubtedly be key, government support will play a central role in enhancing grid infrastructure, ensuring regulatory reform, and de-risking investment in the sector.

Conclusion: No room for government support for oil and gas decarbonization

Government support is needed to reduce emissions of high-emitting industries that are challenging to transition, but proven solutions should be the priority. Governments should focus on industries that will be increasingly necessary in the years to come, attaching strong conditions to ensure significant emissions reductions are achieved. Governments should also focus on supporting workers and communities to plan and implement energy and economic diversification with focus on long-term, good-quality, sustainable jobs.

Fossil fuels are driving climate change, and we expect declining demand in the decades to come, given Canadian and global net-zero commitments. As pressure for the oil and gas industry to lower emissions mounts, Canadian companies should be able to decarbonize independently, without public support, in light of recent strong profits. Even with already-high levels of government support in recent years, industry progress on decarbonization has been slow. Given the uncertain future of the sector because of declining demand and the availability of cost-effective alternatives to many fossil fuel end uses, government support for decarbonizing oil and gas is a risky and ineffective use of public funds. It is also at odds with Canada’s international commitments. Public funds are much better spent on proven tools like renewable energy and energy efficiency, which will enable more long-term emissions cuts. Shifting support from oil and gas to clean energy is critical to simultaneously further our net-zero goals, increase energy security, and reduce energy costs for Canadians.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is part four of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

You might also be interested in

Why Canada’s Energy Security Hinges on Renewables

This deep dive into the evidence shows investing in clean, flexible, and reliable electricity grids is the best option to increase Canadians' energy security, particularly long-term affordability.

Why Canada Needs to Plan for a Steep Decline in Global Oil Demand

This analysis demonstrates that Canada can expect global oil demand to permanently decline in the very near term, as electric vehicle uptake and other societal changes pick up speed.

Why Canadian Liquefied Natural Gas Is Not the Answer for the European Union’s Short-Term Energy Needs

This investigation shows that Canadian LNG infrastructure would come too late to address Europe’s energy security needs and offer little benefit to Canada’s economy.

IISD Annual Report 2022–2023

At IISD, we’ve been working for more than three decades to create a world where people and the planet thrive. As the climate crisis unfolds on our doorsteps and irreversible tipping points loom, our team has been focused more than ever on impact.