Canada’s Energy Future Must Be Guided by Credible 1.5°C Scenarios

The Canada Energy Regulator (CER) has been directed to model the country's energy transition in a way that aligns with the Paris Agreement goal of keeping global warming within 1.5°C. This is a first, and it's a key opportunity to help decision-makers prepare for radically different global energy markets.

Need to know:

- The CER 1.5°C scenarios will be particularly valuable to decision-makers planning for the impact of dwindling global fossil fuel demand as growth of renewable energy capacity in Canada accelerates.

- The Canadian oil and gas industry needs realistic scenarios that fully integrate both short- and medium-term demand outlook and the transition risks associated with climate policies in line with limiting warming to 1.5°C.

- Credible global 1.5°C scenarios need to be comprehensive, transparent, and granular in terms of reporting greenhouse gas emissions, as well as integrate equity considerations into their modelling assumptions.

- Based on the International Energy Agency's (IEA's) Net Zero Emissions scenario and other major scenarios analyzed by IISD, there is no room for new oil and gas fields to be developed in Canada to align with the 1.5°C target.

Mandated by the Ministry of Natural Resources (NRCAN), CER is expected to publish a new set of scenarios this month, modelling Canada’s path to net-zero emissions. This follows a commitment to reach net-zero greenhouse gas (GHG) emissions by 2050, enshrined in law in 2021 and supported by the 2030 Emissions Reduction Plan.

The new NRCAN mandate directs the CER to model Canada’s energy transition in a way that—for the first time—reflects the global context in which the Paris Agreement goal of limiting warming to 1.5°C is achieved. This mandate marks a significant departure from previous Energy Future reports and will ensure the new CER scenarios inform a Paris-aligned energy transition for years to come.

Previous CER modelling focused on projecting energy supply and demand based on economic and energy outlooks. This year, the CER’s task is significantly more complex as it needs to model energy transition scenarios with an explicit climate target. Considering that the embodied carbon dioxide of Canadian oil and gas exports is larger than what the entire country emits domestically in a year, the CER’s 1.5°C scenarios need to grapple with the full range of impacts of the Canadian oil and gas industry.

This is a significant opportunity to provide Canadian decision-makers with a credible tool informed by the best available science as they assess the implications of a 1.5°C-aligned energy transition for Canada and prepare for radically different global energy markets.

The United Nations Environment Programme Emissions Gap Report 2022 clearly shows that the world is not on track to limit warming to 1.5°C. Even if all nationally determined contributions pledges are fully implemented by 2030, the world will still be heading for a 2.4°C–2.6°C temperature rise if countries don’t raise their ambition.

Hence, the CER modelling exercise provides the ideal platform to develop a credible roadmap to a 1.5°C world. This exercise will be particularly valuable for decision-makers who are planning for the impact of dwindling global fossil fuel demand and for accelerating the growth of renewable energy capacity in Canada, considering that Canada is the 4th and 6th largest oil and gas producer, respectively.

Essential Components of Energy and Climate Scenarios

Energy and climate models give insight into how the future may unfold, based on various technical, economic, societal, and policy assumptions. They are generally built as integrated assessment models (IAMs), which bring together simplified versions of the energy, economy, and climate systems. They are the main tool used by academic research groups, intergovernmental organizations, and policy-makers to understand how different energy and technology choices affect our ability to achieve climate goals and impact other elements of the energy transition.

For climate and energy models to provide robust and credible pathways to 1.5°C, they must consider several key elements. Accordingly, the CER should ensure its new scenarios include the criteria below to deliver on its mandate.

Disclose Consistently on All Types of Greenhouse Gas Emissions

Consistent, clear, and accurate reporting of all GHGs is essential for a comprehensive understanding of how to limit warming to 1.5°C. While carbon dioxide emissions from burning fossil fuels are the main cause of global warming, other shorter-lived climate pollutants such as methane, nitrous oxide, and fluorinated gases have higher warming potential. The relative contribution of these GHGs to global temperature rise must be carefully modelled to design effective short- and long-term mitigation strategies.

The Canadian Net-Zero Emissions Accountability Act enshrines in legislation Canada’s commitment to achieve net-zero GHG emissions by 2050. Hence, accounting for all GHG emissions will not only be important to assess the global impact on Canadian emissions for the global climate target but also to plan policies to achieve Canada’s own domestic emissions reduction target.

Report Transparently on Emissions Reductions Versus Carbon Dioxide Sequestration

Knowing the relative contribution of emissions reduction versus carbon dioxide removal (CDR) and offsets is essential to assess whether a climate model can realistically reach its target. The Intergovernmental Panel on Climate Change (IPCC) Special Report on 1.5°C explicitly warned that “CDR deployed at scale is unproven, and reliance on [CDR] is a major risk in the ability to limit warming to 1.5°C.” The assumptions a model makes about CDR as well as the expected reductions from carbon capture and storage (CCS) in the fossil fuel sector (fossil-CCS) have a major impact on the relative mitigation efforts required to limit temperature rise to 1.5°C. Credible and feasible assumptions about the use of CDR and CCS are especially critical to reliably estimating the rate at which oil and gas must be phased out. Moreover, relying on forest carbon offsets is also problematic: well-documented issues over additionality, performance, double counting, and leakage generally prevent accurate assessments of these offsets’ sequestration potential.

Considering these technologies’ risks, high costs, and limited mitigation potential, the CER should limit the reliance of their 1.5°C scenarios on fossil-CCS and CDR to the IPCC feasibility and sustainability thresholds to remain realistically implementable. Rapid and deep GHG emission reductions are essential in all credible 1.5°C scenarios. While CCS technologies are a crucial component of all climate models, their deployment is slow and has limited scale, and application should be restricted mainly to hard-to-abate sectors, such as cement and steel. To assess the sensitivity of their mitigation pathways to these assumptions, the CER should also create one scenario with zero CDR and CCS.

Include Granular Sectoral Emissions Reduction Pathways

Limiting warming to 1.5°C will require different emissions reduction solutions in each sector, which will necessarily occur at different paces. However, immutable constraints on the 1.5°C carbon budget—the maximum amount of CO2 that can be emitted over a period of time to limit global temperature to 1.5°C—mean that slower mitigation efforts in one sector will need to be compensated for by faster reductions in other sectors. In other words, giving one sector a bigger carbon budget leaves a smaller carbon budget for other sectors. Hence, governments need sector-level data to rationally distribute effort across sectors and track overall progress toward the Paris Agreement goal.

Accordingly, CER scenarios should feature sectoral mitigation pathways to provide useful guidance for Canadian policy-makers, energy producers, providers, and financial actors. Not only does the CER scenario need to show the trajectory of emissions reductions in each sector, it should also describe how electricity generation will be ramped up to accommodate the necessary declines in fossil fuel use in other sectors, such as transportation and buildings.

Integrate Equity Considerations

Modelling assumptions must also reflect a fair distribution of mitigation efforts across countries in line with the United Nations Framework Convention on Climate Change's principle of Common but Differentiated Responsibilities and Respective Capabilities. While most IAMs are based on least-cost assumptions—allocating a large share of mitigation efforts where they are the cheapest—this tends to put a higher burden on developing countries. Equitable and fair pathways must consider that fossil fuel production from large historical emitters with highly diversified economies, relatively low dependence on fossil fuel production, and high GDP per capita need to cut their emissions faster than the global baseline.

Canada, together with Australia, the United Kingdom, the United States, and Norway, belongs to this category of countries and has a responsibility and the capability to mitigate its emissions faster than the average emissions reduction trajectories in global 1.5°C scenarios. Moreover, global oil and gas production needs to decline rapidly by 2030 to allow emerging economies adequate time to phase out their coal dependence while meeting their social and economic goals.

Rapid and deep GHG emission reductions are essential in all credible 1.5°C scenarios. While carbon capture and storage technologies are a crucial component of all climate models, their deployment is slow and limited at scale.

Common Features of Paris-Aligned 1.5°C Scenarios

Analyzing a wide set of global scenarios is useful for exploring the implications of different policy and technology choices on the required mitigation efforts in different sectors and countries. This can also help assess the sensitivity of certain features of the energy transition to various model assumptions. IISD’s analysis of hundreds of 1.5°C scenarios shows that, despite a wide variety of assumptions and model outputs, all major 1.5°C scenarios share certain key features.

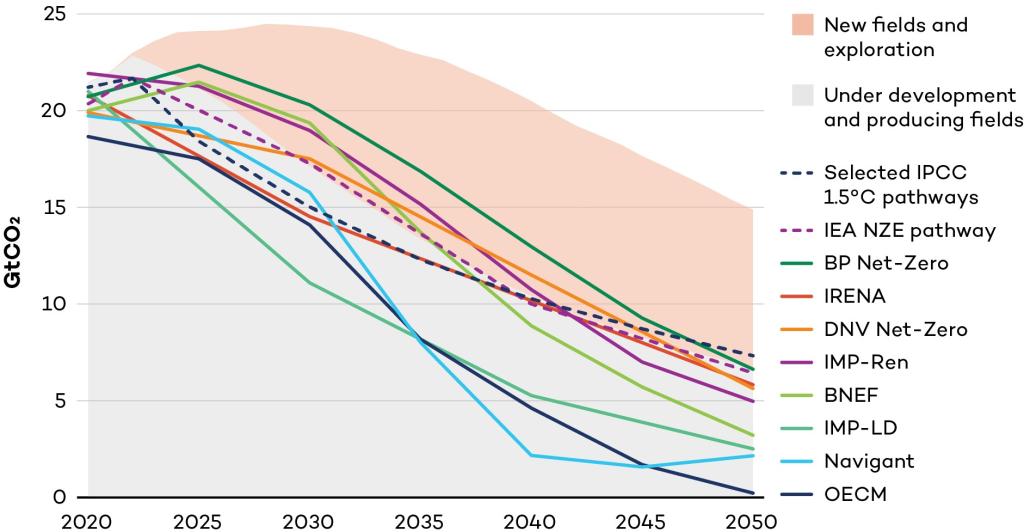

As shown in Figure 1, IISD’s analysis of all 1.5°C scenarios considered by the latest IPCC report finds that global oil and gas production needs to decrease 30% by 2030 when using feasible and sustainable amounts of CCS and CDR. Moreover, assessment of the IPCC Illustrative Mitigation Pathways, other 1.5°C scenarios from intergovernmental organizations including the IEA, the International Renewable Energy Agency, and various energy consultancies, all showed that oil and gas production needs to decrease at least 65% by 2050.

Analyzing these scenarios confirms the IEA’s conclusion that there is no room for any new oil and gas development globally. There is more than enough oil and gas stored in fields already in operation or under development to meet global demand in 1.5°C scenarios, and we must avoid developing or exploring for any new oil and gas fields.

This context underscores the need for the upcoming CER 1.5°C scenarios to show the implication of global models for the Canadian energy transition. They need to enable Canadian decision-makers to consider the impact of reducing domestic emissions in line with limiting warming to 1.5°C which—as all major scenarios indicate—implies a rapid decline in oil and gas production and consumption.

Currently, Canada’s net-zero targets, including targets for the oil and gas sector, only cover Scope 1 and 2 emissions. For the oil and gas sector, this accounts for emissions from extraction and production, which constitute only about 20% of the sector’s total emissions. Conversely, so-called Scope 3 emissions represent about 80% of the Canadian oil and gas sector's emissions. These emissions associated with the combustion of fuels exported to third parties are typically excluded from domestic net-zero calculations, and don’t feature in Canada’s 2030 Emissions Reduction Plan. However, they cannot be ignored when modelling global 1.5°C scenarios—to limit warming, all emissions sources must be included regardless of where they are emitted. Accordingly, all global 1.5°C scenarios necessarily show declining oil and gas production in the coming decades since most Scope 3 emissions, for instance tailpipe emissions, cannot be sequestered through CCS.

In 2019, emissions from the combustion of Canadian oil and gas exported internationally, Scope 3 emissions, accounted for more than 954 MtCO2—greater than Canada’s entire domestic emissions. Hence, in a world where warming is limited, decision-makers will require tools to assess the impact of a dwindling demand for oil and gas exports and to plan for the scaling of renewable energy sources to meet Canadian energy demand.

Canada Energy Regulator Current and Evolving Policies Scenarios

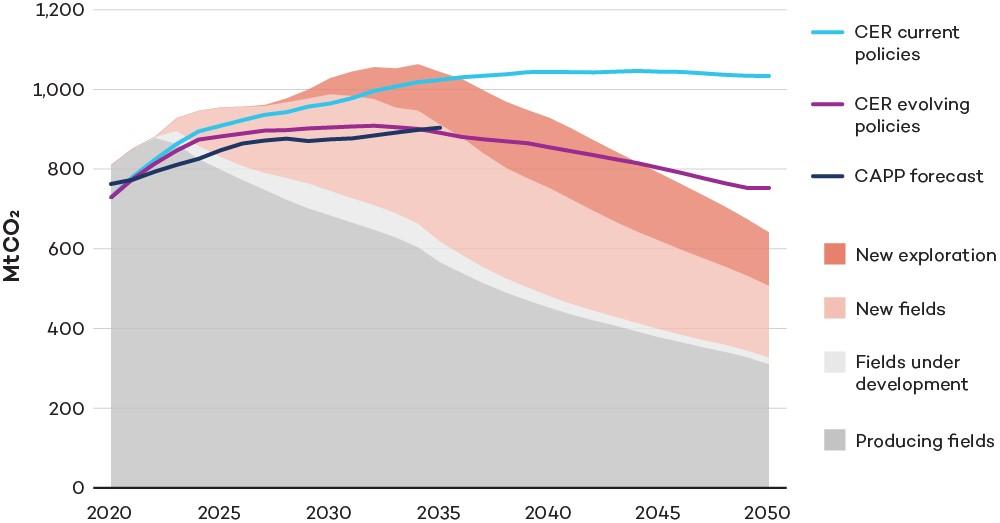

The CER’s most recent modelling shows that if Canada were to only maintain policies already in place, oil and gas production would continue to increase until the 2040s. The CER evolving policy scenario—which models a future with increasingly ambitious climate policies—estimates that production would still increase until the 2030s before beginning to decline slowly thereafter, which is roughly consistent with the Canadian Association of Petroleum Producers’ forecast for the oil and gas sector. These scenarios were not designed to consider the global context and on their own are insufficient to understand the impacts of declining fossil fuel demand in 1.5°C-consistent scenarios.

As shown in Figure 2, both CER scenarios imply that opening new oil and gas fields and undergoing new exploration would be necessary to support the forecast increase in production levels. This is largely because these scenarios relied on much higher oil and gas price and demand assumptions than what energy analysts are now forecasting. Energy markets were tumultuous in 2022, significantly impacting the longer-term outlook for global demand.

Canada’s biggest export market, the United States, has implemented the Inflation Reduction Act which is enforcing policies and channelling hundreds of billions of dollars to accelerate the energy transition. Combined with a ramping up of U.S. gas production and export capacity, these developments are expected to reduce U.S. demand for fossil fuels. There has been considerable volatility in energy markets over the past 3 years. However, in general, the result is a faster transition away from fossil fuels.

Accordingly, it is becoming increasingly clear that the global demand for Canadian oil and gas is expected to decline and that exports will be less competitive. Canada's carbon-intensive oil and gas industry needs more realistic scenarios that fully integrate both short- and medium-term demand outlook and the transition risks associated with climate policies in line with limiting warming to 1.5°C.

If Canadian oil and gas production were 1.5°C-aligned, based on the IEA NZE scenario and other major scenarios analyzed by IISD (see Figure 1), no new reserves would be developed and, at a minimum, production would follow the natural decline rates of the fields already in production or under development. Extraction levels that exclude any new oil and gas fields indicate that production would peak at about 60 billion barrels of oil and gas in 2023 before decreasing by about 20% by 2030 and 70% by 2050.

Accordingly, Canada urgently needs to start planning for a Paris-aligned oil and gas production decline. Such an energy transition requires a rapid scale up of renewable energy production together with electricity grids and storage infrastructure. A 1.5°C-consistent CER scenario should help plan this accelerated energy transition while exploring the implications and opportunities of aligning with the Paris Agreement.

Canada Needs a Credible 1.5°C Scenario to Inform a Managed Phase-out of Oil and Gas Production

As one of the largest oil and gas producers globally, Canada has a significant role to play in limiting global warming to 1.5°C through its energy transition. CER scenarios will be critical to assessing its impact on the Canadian energy sector and economy. A pathway to net-zero emissions in Canada that simultaneously contributes to the world meeting the Paris Agreement goals can also be a roadmap for other high-income fossil fuel producers with highly diversified economies.

For CER scenarios to fulfill the NRCAN mandate and play these roles successfully, a few key elements cannot be ignored. The scenarios need to:

- Disclose consistently on all types of GHG emissions

- Report transparently on the relative contributions of emissions reductions versus removals and offsets

- Include granular sectoral emissions reduction pathways

- Integrate equity considerations into the modelling assumptions

Modelling from leading energy institutions around the world consistently demonstrates that it’s possible to implement a just energy transition while boosting the economy and supporting communities. An ambitious CER 1.5°C scenario is crucial in providing essential guidance to navigate an accelerating energy transition and declining oil and gas demand and production in a way that serves Canada’s best interests. It will influence the expectations of energy producers, energy consumers, investors, and policy-makers on the global energy supply outlook for years to come.

The CER has the potential to provide a roadmap to steer energy producers’ investment decisions and enable financial actors to adopt Paris-aligned strategies that can support Canada’s transition to a bright clean energy future. Now’s the time to take advantage of it.

You might also be interested in

Navigating Energy Transitions: Mapping the road to 1.5°C

This report aims to inform policymakers, investors, and companies on how to align with the goals of the Paris agreement, based on 1.5°C-consistent energy/climate pathways.

The Critical Next Step: What you need to know about Canada’s 2030 climate target

Canada's climate target for 2030 is within reach, but more stringent policies and clearer government communication will be needed to get there. Our expert explains why these developments are critical for Canada to help avoid the worst impacts of climate change.

Ottawa supports Big Oil over the climate

One can only imagine the positive buzz these days inside the boardrooms of Canada's oil companies, as they rake in record profits and plan major expansions of their oil production. Amid all the good cheer, one could easily lose sight of the fact that those plans will push the world dangerously closer to the brink of irreversible climate chaos. Even as the world finally signed a commitment at UN climate talks last month to begin transitioning away from fossil fuels, Canada's major oil companies are poised to do exactly the opposite — to greatly expand their fossil fuel production.

Feds and province veto offshore oil exploration in Nova Scotia

A licence to explore the offshore of Nova Scotia for oil and gas and restart fossil fuel activity there after years of dormancy was rejected Monday by the federal and provincial governments. The decision to reject the licence considers broader policy focused on "shared commitments to advance clean energy and pursue economic opportunities in the clean energy sector, which are beyond the scope of the board's regulatory purview," a joint statement said.