Launching the Sustainable Finance Map of Geneva

A new map of sustainable finance players in Geneva could be a vital tool to scaling up funding for the Sustainable Development Goals.

One of the greatest challenges to achieving the Sustainable Development Goals (SDGs) is paying for them.

Mobilizing the estimated USD 5 trillion to 7 trillion per year needed to achieve the 17 comprehensive goals requires more than a concentration of government funding or an increase in corporate generosity. Sustained investment on this scale requires a system shift in the fiscal policies, private incentives, aid mechanisms and trade networks that underpin almost every aspect of human life.

It requires aligning the work of every organization exploring sustainable finance… no matter how different those organizations may be.

I live in Geneva—one of the world’s recognized financial hubs. The city is known for having two distinct “sides of the lake.” There’s the right bank, made up primarily of international Geneva actors, such as United Nations entities and non-governmental organizations (NGOs), who work on sustainable development, humanitarian responses and human rights. The left bank is the home of private sector players in finance, biotech and luxury goods, among others.

My work at the Geneva 2030 Ecosystem is to build collaboration between those sides. The network enhances connections between Geneva-based financial actors, government representatives, NGOs and community leaders, mobilizing their skills and expertise in service of the SDGs.

Choosing “ecosystem” as our title was deliberate. In a biological ecosystem, interactions between organisms matter just as much as the individual entities themselves. It is not enough for a single species to thrive—the entire complex system must be interconnected and well linked to function as effectively as possible. Likewise, in Geneva, the relationships between organizations must be healthy for community members and the wider world to progress.

This is a fundamental principle of the 2030 Agenda, which paints an integrated, systemic picture of sustainable development and reinforces the notion that people, prosperity, peace, partnerships and the planet are intrinsically linked.

Recently, IISD and its partners Sustainable Finance Geneva, the SDG Lab and the Canton de Genève launched an interactive mapping to better understand the organizations working on sustainable finance in and around Geneva. This is the vital first product in a broader collaboration around sustainable finance.

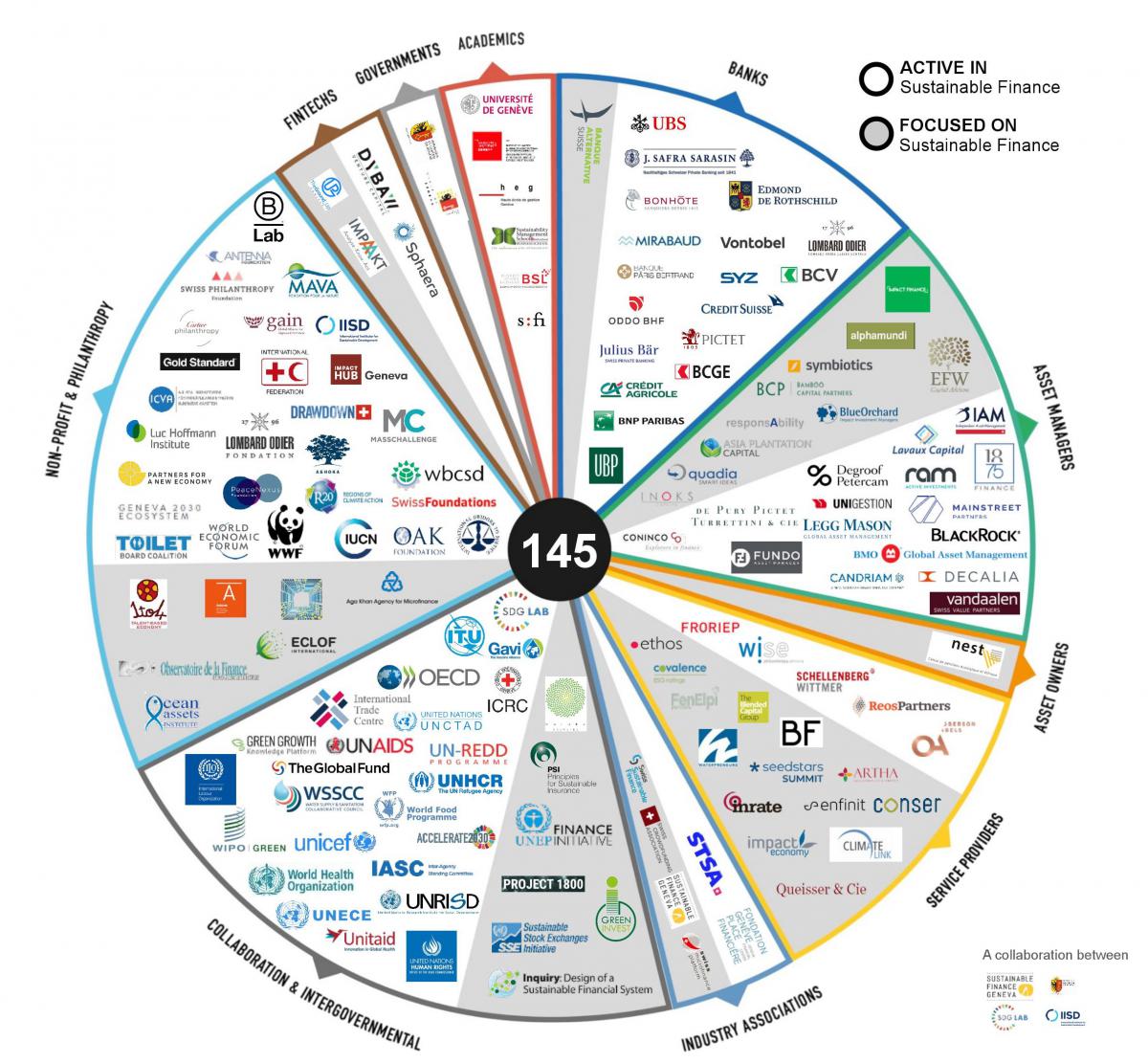

This comprehensive map identifies 145 organizations on both sides of the lake working on sustainable finance in some way. These organizations span all major sectors, from private sector players (banks, asset managers, etc.) to academic institutions, international organizations, collaborations and industry associations. Even the local government, the Canton of Geneva, launched a green bond! The organizations listed on the map also have unique and varied approaches. Sustainability is core business for some organizations; for others, it is a growing business segment they are starting to understand and develop products/projects around.

The map also defines the roles and activities the entities play. Some directly offer financial products and services, but there is also a range of intermediaries, capacity builders, and service providers that support the overall system to make this “ecosystem” work.

Developing this map has been a long process. It started with interviews and research before sharing several versions with the partners to make sure categorizations were appropriate and resonated with the private financial community as well as the international community. The Canton de Genève then converted the data into an interactive portal using Esri’s ArcGIS technology.

Now we’ve opened a public consultation to ask the ecosystem directly if we have gotten it right.

Why put all this effort into a map? Strengthening an ecosystem starts with a comprehensive understanding of who is doing what. This is how potential synergies can be identified and innovative financial vehicles built. The two sides of Lake Geneva speak different languages (literally and figuratively in some cases) and are driven by different incentives and priorities. This map helps make sense of those differences and the vast amount of activity underway. Most importantly, it provides a road map for identifying and reaching out to potential collaborators.

Closing the funding gap for the SDGs will only be possible if we are able to innovate and find new ways of driving capital to sustainable development. It’s a big challenge, but it has a huge potential reward: opening the doors to the fairest, most prosperous future humanity has ever articulated.

American artist Mark Jenkins said, “Maps encourage boldness.” With our new map in hand, the Geneva 2030 Ecosystem partners agree.

Further reading

Blog: Davos, Sustainable Development and an Open Mind

Blog: Cleaning up Toxic Soils in China: A trillion-dollar question

Report: Leveraging Sustainable Finance Leadership in Canada: Opportunities to align financial policies to support clean growth and a sustainable Canadian economy

You might also be interested in

Davos, Sustainable Development and an Open Mind

What did a sustainable development professional take away from mingling with the billionaires, world leaders, technocrats and financiers of Davos?

Burning Billions: Record public money for fossil fuels impeding climate action

This briefing provides the latest evidence on how the world is aligning public financial flows with the need to reduce GHG emissions.

IISD Annual Report 2022–2023

At IISD, we’ve been working for more than three decades to create a world where people and the planet thrive. As the climate crisis unfolds on our doorsteps and irreversible tipping points loom, our team has been focused more than ever on impact.

Revisiting Tax Incentives as an Investment Promotion Tool: Q&A for investment policy-makers

Are tax incentives effective at attracting investment in developing countries?