E-Commerce Takes Centre Stage at World Trade Organization in Run-up to MC13

This article follows trade-related discussions on e-commerce in the run-up to the upcoming WTO's 13th Ministerial Conference, pinpointing its re-emerging relevance under the Work Program on Electronic Commerce and the Joint Initiative on E-commerce. Yasmin Ismail and Rashmi Jose extrapolate the fundamental underlying debate of the e-commerce moratorium’s impact on international trade policy.

This article describes the progress and dynamics of discussions under the Work Program on Electronic Commerce and the Joint Initiative on E-commerce after the Twelfth Ministerial Conference (MC12) in 2022, as background to possible progress on both discussions at MC13 in February 2024.

Thematic Dedicated Discussions Revive the Work Program’s Relevance

Trade-related aspects of e-commerce have been discussed at the World Trade Organization (WTO) since 1998, as mandated by MC2’s Declaration on Global Electronic Commerce. The declaration called for a Work Program on Electronic Commerce and for a provisional moratorium on customs duties on electronic transmissions. This moratorium has been extended for around 2 years at every ministerial since then.

Discussions under the work program have been described as slow and halting, yet important to keep e-commerce on the member-agreed multilateral agenda. At MC12, however, as plurilateral discussions on e-commerce (described below) gained momentum, members released a ministerial decision highlighting their intention to reinvigorate efforts under the work program and to ensure that the discussions emphasize the development dimension.

Discussions under the work program have been described as slow and halting, yet important to keep e-commerce on the member-agreed multilateral agenda.

Work has indeed ramped up. Eight dedicated discussions were held between January and November 2023, covering a range of development-relevant thematic matters. These include consumer protection, the digital divide, improving the participation of developing economies and least developed countries (LDCs) in e-commerce, regulatory and legal frameworks, customs duties on electronic transmission, digital trade facilitation and electronic transactions, digital industrialization, upskilling, and technology transfer. Members are also engaging by submitting more proposals or communications that recommend future agenda items, facilitate knowledge sharing, and support the thematic discussions.

In the run-up to MC13, the facilitator of the work program discussions has asked members if any of the issues discussed in the thematic meetings could be the subject of a recommendation put forward at the ministerial conference. The facilitator has also asked members how to make the work program even more effective in responding to today’s challenges and for development.

More Participants and Intensified Negotiations

Discussions on electronic commerce are also taking place plurilaterally at the WTO. At MC11 in Buenos Aires in 2017, 71 WTO members launched a new joint statement initiative (JSI), starting with exploratory talks toward future WTO negotiations on trade-related aspects of e-commerce. These talks turned into formal negotiations in January 2019. While all WTO members can participate in the negotiating meetings, formal participation in the negotiations is limited to a subset of members (currently 90).

Although this represents just 55% of all WTO members, the group includes many of the largest trading countries: trade among these members accounts for more than 90% of global trade. Developed economies and large emerging economies are engaging, including the United States, the European Union (EU), China, and Indonesia. Compared to the other JSI (the Investment Facilitation for Development Agreement, or IFDA), developing economy and LDC participation is more limited. Only eight of the 90 members are from Africa, and five are LDCs. Some large emerging economies, such as India and South Africa, aren’t engaging because they object in principle to these plurilateral negotiations.

Different positions are due to the distinct commercial interests and regulatory approaches of countries.

The negotiations have had to reconcile different member positions on the types of rules to prioritize within an international framework. An expert view notes these different positions are due to the distinct commercial interests and regulatory approaches of countries. For example, earlier in the process, the United States pushed for rules to ensure the free flow of data across borders—rules that could benefit the expansion of digital service firms. China and the EU advocated for a more cautious approach, seeking to maintain policy space for national security or privacy priorities. China’s main push was for trade facilitation and market access benefits, rules that would benefit the flow of traditional trade enabled by digital platforms. Developing country members focused on implementation flexibilities and capacity-building benefits. Members also have distinct positions on custom duties, with developed economies advocating for a commitment to impose a permanent moratorium and some developing economies preferring to align their commitment to a moratorium with decisions made under the WTO Work Programme on E-commerce.

During the negotiating process, proposals that lacked sufficient support to make it to the formal text—such as additional goods and services market access commitments—were moved to an annex section of the negotiating text. These issues were then dropped from consideration at the end of 2023.

Data Flow Issues Put on Back Burner

Importantly, and due to recent developments, articles on data flows, data localization or location of computing facilities, and source code are no longer being considered. These articles were shelved after the United States Trade Representative announced on October 23, 2023, it was withdrawing support for proposals on these issues, citing a need to maintain policy space as debates around domestic policy considerations unfold. This move meant the “shelving” of issues considered the most challenging to negotiate due to the diverging positions of members such as the United States, the EU, and China.

Dropping data-related issues prompted concerns that the negotiations won’t deliver an ambitious outcome. But the co-conveners—Australia, Japan, and Singapore—defended the emerging shape of the slimmed-down package, arguing that “even though it does not meet all our expectations, it is a substantive package that delivers benefits to consumers, businesses and members.”

Dropping data-related issues prompted concerns that the negotiations won’t deliver an ambitious outcome.

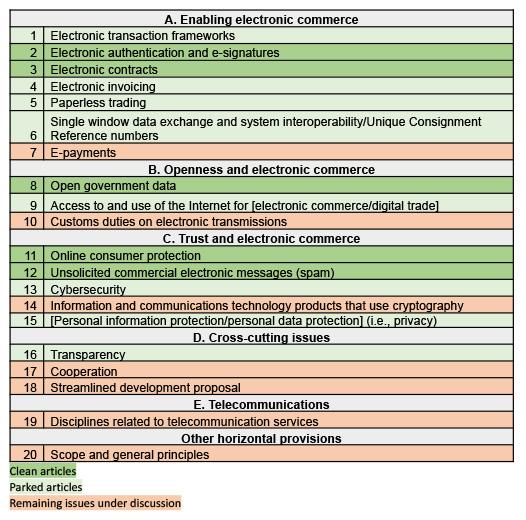

The co-conveners had aimed to deliver a substantial conclusion on several digital rules in the JSI by the end of 2023. These articles include a set of articles broadly stabilized through small group discussions (referred to as “parked articles”) and another slate of articles that are fully “clean.” The co-conveners also hope to see more convergence toward landing zones on the remaining issues. The table below summarizes the parked articles and the remaining issues being discussed for landing zones.

Participants in this JSI may unveil a finalized version of the core text of the e-commerce agreement in the coming months. Discussions on including the agreement in the WTO framework will likely take place only after MC13. Incorporating the text of a plurilateral treaty into the WTO’s legal architecture requires consensus among all WTO members and, as noted above, some oppose these negotiations in principle.

Participants in the e-commerce JSI will likely follow the legal architecture debate surrounding the incorporation into the WTO rulebook of the treaty text produced by the other plurilateral initiative, the IFDA, to assess their options. A lack of consensus among the full WTO membership to include the IFDA as a plurilateral accord will likely have a knock-on effect on the feasibility of incorporating the e-commerce agreement within the WTO. If this scenario plays out, it is unclear what will happen to the JSI agreements if they don’t proceed as WTO agreements—whether they can move forward as non-WTO accords or whether other options may emerge.

Ramped-up Debates on Customs Duties Moratorium

An important topic discussed at the multilateral level through the work program and in the plurilateral joint initiative process is the moratorium on customs duties on electronic transmission.

As mentioned, the MC2 declaration that mandated the setup of the work program also called for maintaining a moratorium on tariffs on electronic transmissions on a provisional basis. This moratorium has been extended in subsequent ministerials. However, in recent ministerials, a hotly contested debate has emerged on whether this should continue to be the case. A group of developing economies threatened to block the extension at MC12, and an agreement to maintain the moratorium was only secured in the final days. The MC12 decision says members agree to extend the moratorium until the next ministerial or until March 2024 if a ministerial isn’t held by then. Members also agreed to intensify their engagement in reviewing the scope, definition, and impact of the moratorium.

Debates on definition and scope seek to assess what products can be taxed in the first place. One debate is whether electronic transmissions should be treated as a good (in which case tariffs can apply) or a service or forego the categorization altogether. Another seeks to determine if duties should be applied to the content carried through electronic transmissions or only to the transmission’s signal (the bits and the bytes).

The fundamental underlying debate, however, is about the moratorium’s impact. One strand of the debate is the potential for lost government revenue. Some large developing economies argue that by not imposing tariffs on goods that are increasingly being digitized, they face major government revenue losses. Opposing views say the revenue loss is relatively small and can be covered by applying internal taxes.

The fundamental underlying debate is about the moratorium’s impact.

Another strand relates to members’ ability to implement industrial policy strategies. Some developing economies say lifting the moratorium is important so countries can access policy space, implement strategies to protect and facilitate technology transfer, and help their nascent digital industries that are significantly lagging behind their developed economy counterparts. Opposing views, put forward by a group of developed economies as well as several developing economy members, say the moratorium reduces trade costs and this, in turn, benefits consumers and increases opportunities for businesses, including by enabling more small firms to trade. In essence, they argue the economic benefits of a continuing moratorium far outweigh the potential benefits of imposing customs duties on electronic transmissions as part of a protectionist-oriented industrial policy strategy.

Members will debate these matters in dedicated meetings in the run-up to MC13. Will members’ positions evolve, or can we expect another tense runoff at the ministerial that results in the moratorium’s expiration or another provisional extension? The outcome of the multilateral moratorium discussions will shape options for plurilateral discussions on the same topic that will continue after MC13.

E-commerce will feature in many ways at MC13. Most importantly, negotiations will determine whether the moratorium lapses or is extended. The e-commerce JSI negotiations will present a next-to-final core text of a proposed treaty. The ministerial may reveal if there is a feasible path for JSIs—including the e-commerce treaty—to be incorporated into the WTO rulebook. Finally, it provides an opportunity for the reinvigorated multilateral discussions held through the work program to deliver valuable recommendations and become even more effective.

You might also be interested in

Big trade deals likely elusive at WTO meet in Abu Dhabi

Several issues remain stuck in the weeds ahead of the World Trade Organization's biennial ministerial meeting, as anxiety swells over the impact that geopolitical tensions and the looming US elections could have on global trade.

Africa's Biggest Oil and Gas Finds Are Doing Little for Economies at Home

Domestic markets across the continent are no match for the lucrative ones beyond its borders.

The Investment Facilitation for Development Agreement: A reader's guide

A subset of World Trade Organization members has finalized the legal text of an Agreement on Investment Facilitation. This Reader's Guide provides an overview of what's in the agreement.

Urgent Action Is Needed to Better Reward Tea Farmers for Using Sustainable Practices

There are 13 million people propping up the global tea industry. Two thirds of those people are smallholder farmers in developing countries, many of whom live in poverty. New research from the International Institute for Sustainable Development unearths the latest consumption and production trends in the sector and explores why so many tea farmers are struggling to make a living.